⚙️Lever Up Kick-off ⚙️ & Improving Your Research Process

A warm welcome, why this is in your inbox, and what to expect. Also, how-to notes on value-added research.

Congrats! Last Friday you received an email (or stumbled onto my WSO post) somewhat illustrative of the types of happenings we will discuss here (in case you missed it). This landed in your inbox because you fall into one of the three esteemed categories:

You are one of the first 63 organic subscribers, great job getting in on the ground floor!

You are a friend/colleague/peer, I value your opinion, and I pretty much sent you this letter without as much as a text message warning. Unsubscribe at your own risk.

I like your stuff on Fintwit/IG and sent you a copy of my post in hopes you find it amusing (enough to share). If you hate the stories, writing style, or characters discussed in this letter, please hit unsubscribe and I shan’t be bothering you further. As a consolation for spamming your inbox, I’ve linked to your website (where available) at the bottom of this letter.

Over the coming weeks (months?) I will try to peel back the curtain on some of my more entertaining experiences, all the while sharing my thoughts on recent M&A activity. In the meantime, below are some learnings on how to improve your research process, whether you are sourcing new ideas or reviewing a potential investment.

As always, if you know someone who’d love to get Lever Up in their inbox (or has been involved with the subject of discussion), I encourage you to forward this to them!

Proprietary Research

“Per aspera ad alpha.”

-Hedge fund manager with a Classical education, probably

I would have liked to start this post with trend data on the frequency of investment managers mentioning “proprietary [research/sourcing]” on their websites and in their fundraising docs, but in the absence of my ability to delegate this exercise to an intern (due, in large part, to lack of an intern) you will have to take my word for it. This is actually convenient because the subject of this memo is aggregating and weighing anecdotal evidence to gain a deeper understanding of the undercurrents which run through the market you are seeking to analyze.

While much digital (and literal) ink has been spilled on proprietary/value-added/scuttlebutt research with regard to public markets investing, my goal is to capture these scattered notes in a single (though by no means exhaustive) composition and highlight (what I believe are) the more relevant considerations for private equity. This post is intended to cover the process of conducting field research and takes for granted that you already have a sense of the kinds of questions you should be asking (if not, check out Meb Faber’s notes on VAR). For a more general research guide with a public market perspective, read this post by Simple As.

The idea of scuttlebutt, or “grapevine,” research, traces its roots to Phil Fisher and has surfaced a few times in the recent past:

Buffett discussed how he used it in evaluating American Express

John Griffin’s Value-Added Research (VAR) methodology overlaps with Fisher’s philosophy and admittedly sounds more professional and less folksy. I can’t find a good public link to share (he’s taught at UVA and CBS) but the lore is that while Griffin was at Tiger he came up with the idea to speak with non-Wall Street contacts

Why bother?

Firstly, this type of research complements high-level market studies you may review from IBIS, Gartner, Statista, or and other similar providers. It is certainly much more “bottom-up” than “top-down.” It’s also less filtered than commentary you may read in sell-side research (if you even have access to relevant sell-side research).

Secondly, you may be researching markets that do not have significant coverage from traditional research sources. In this case, there is truly a limited amount of desktop work that can be done before you have to start going (dialing) out and talking to people in the immediate or adjacent industries.

Thirdly, this is an area where you can start adding value early in your career. When you were a hopeful tadpole reading M&I you may have come across this post. Many of your peers secretly prefer to spend their days in Excel and PPT (I say secretly because candidates may very well get cut from recruiting if they actually say this during an interview). Unless you work in a firm that encourages/demands this type of research and instills best practices within its Associates (congrats! also, you should be writing this, not me), taking initiative can help you differentiate yourself and contribute to the investment process in a meaningful way.

Last but not least, this can meaningfully improve your decision-making process. Conducting field research enables you to (i) validate your variant thesis (What do I have to believe? Can the business be fixed? Do I understand the risks?), (ii) better distinguish value investments from value traps, and (iii) equip yourself with the knowledge that builds conviction.

A Note on Expert Networks

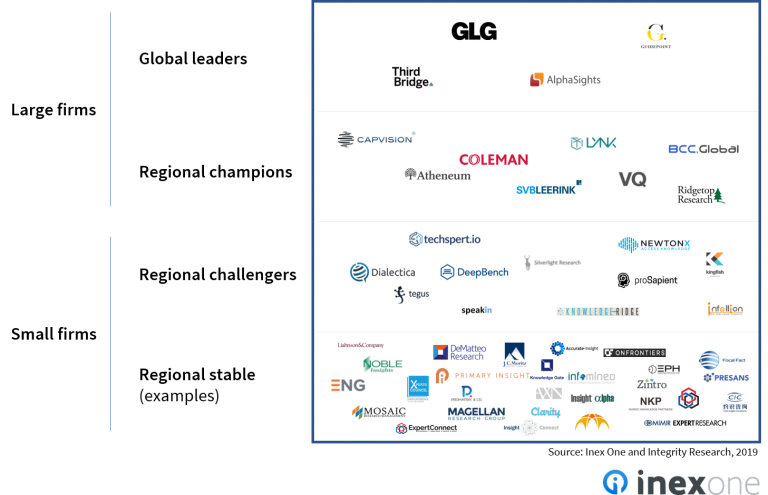

For the uninitiated, Expert Networks are organizations that serve as platforms to connect investors with subject matter experts. They started developing formally in the early 2000s after SEC enacted Reg FD and gained notoriety around the financial crisis as regulators took notice of the fact that the aforementioned experts may be sharing a bit too much (specifically, experts may be working for a public company or with a public agency that enacts policies which affect public stocks, and the information they disclose to investors may not be theirs to share). Some notes on alleged mischief here, here, and here. Despite the hiccups, the expert network market has grown to the size of $1.3B in 2019 as investors, both public and private, seek to gain an informational edge to their thesis. More recently, MIFID II seemingly had the effect of moving dollars away from corporate access (traditionally under the purview sell-side research) and toward expert networks. Inex One created a helpful market map so you can see where different firms stack up in the pecking order.

The downside is that access to experts through such platforms doesn’t come cheap. If you are working on (even a smaller) deal and are looking to validate or challenge your original assumptions, the cost may certainly justify what you uncover. However, if you are researching a particular market with an eye toward generating new ideas, it is unlikely your VP/MD would give you the green light to make some feeler calls that run $500-1,000 per hour. (NB: if the cost isn’t allocated to a specific deal or an existing PortCo, it gets allocated to the GP, aka it comes out of the management fee, aka your Partners’ pockets.)

The rest of this post will focus on what you can do with limited resources to identify new opportunities (or markets to avoid), improve your diligence process, and potentially expand your professional network. Without further ado…

Proprietary Research (actually, this time)

You have combed through your usual sources, databases, and news publications and have a broad understanding of the subject sub-sector or niche. You even skimmed through industry publications, at least those without a paywall, and you feel that the space is interesting enough to warrant further digging. At this point, you either (i) are conducting preliminary diligence on a potential acquisition target, or (ii) blocked off some time from your other responsibilities to focus on canvassing a market for potential ideas.

Sources

Conferences: If you have the time and budget (or are actively involved in Business Development and Sourcing), industry conferences can be a good way to connect with industry professionals, Founder/CxO types, and Corporate M&A folks. My hope is that you establish enough of a rapport before hitting them with the zinger (“Have you considered partnering with a private equity firm?” you say, as they run screaming in the other direction). This works best if you are covering a specific industry and have the time (or mandate) to become at least somewhat an expert in the space. Corporate M&A contacts may be bidding against you today, and seek to divest non-core assets tomorrow. Check-in on your newly found connections occasionally, share a relevant headline and ask for their opinion, and once an actionable opportunity presents itself, or you need some inside perspective, reach out and ask them for a call/coffee.

Meetups and smaller events: I spoke on an industry panel that’s only adjacent to my area of interest, but ran into a Founder of a business that’s very well within my coverage. There are regional events, product-focused workshops, and everything in between. Admittedly the caliber of event and crowd is not what most of you are used to, but that’s part of getting out of the bubble.

Industry periodicals and journals: Reach out to a journalist, or better yet the editor. They have their finger on the pulse of their industry and speak to dozens of practitioners.

Your Firm’s Operating Partners/Advisors: Depending on your org structure, you may be working closely with an Operating Partner to generate investment ideas around her/his domain of expertise. If you are reviewing a live deal, your VP/MD will typically bring in the operator when they deem necessary. Otherwise, consider them as your free-ish expert network (this should go without saying, but if you are new and haven’t met with the entire roster of “part-time” operating advisors whose portraits decorate your firm’s website, ask your VP/MD for an intro first).

PortCo Management: If you are working on an add-on for an existing platform, you may already be doing this alongside the platform’s management team. If you are looking at businesses in adjacent areas, you can reach out to the PortCo team for their opinion.

B-school alumni: IYKYK.

Other: LinkedIn for (retired or active) executives, press releases, conference attendees, former panel speakers. Probably a myriad of potential sources I am neglecting to mention.

Process

Your goal is to learn more and challenge (or validate) your original assumptions about the market. Speaking with customers, competitors, suppliers, and other industry veterans is a great start.

When looking to source new investment ideas, you are hoping to uncover an opportunity that may have been overlooked or buried too deep for others to find. The industry operators may know where the bodies are buried, while your roommate who works at a competitive fund can’t be bothered with anything not neatly packaged together by a banker running a formal process. Occasionally, the operators may not even be fully aware of the potential for value creation, this is where your understanding of the market can pay off. In diligence, you want to create a process to counteract your blinders to find out the truth, rather than an index to what you think should be right. Since there is no way to know if you are getting skewed information, you have to learn to weigh people’s opinions. This process can be difficult and time-intensive, so often people don’t bother.

Some practical tips to help you get started (mostly copied from a recent lecture):

A lot of your success will be in the form of “human helping a human”

An email should not sound like a form, be mindful of people’s perception of the investment management industry and try to not come across as a tool

Always write a thank you note after a conversation

Appeal to people’s desire to be the expert that they don’t have the ability to be in their everyday life

Don’t be afraid of the phone; this is a number’s game and only a fraction of the calls get returned; keep going and you will eventually make all the calls you need to get enough information to make an informed decision

The art of interviewing: be prepared, think of multiple ways to ask the same question, don’t lead the witness

Review recent industry publications, press releases, and sell-side reports

Prepare a list of open-ended questions (“X is happening, why do you think that is?”

Seek to collect observations, not opinions

Write down everything the individual says, you may not notice what’s important at the beginning

On a closing note, if you are looking at businesses that touch consumers, be sure to get as close to the consumer experience as possible. Recent (albeit tangential) examples of this include the Morgan Stanley banker who moonlighted as an Uber driver and literally every bank dressing up in Lululemon gear to pitch for the IPO. While it may only marginally improve your understanding of the business, it can help you land a deal and will provide for hilarious content during your next offsite.

They're not sponsoring me, I'm just trying to get them to: Top Tweets from Ramp, TheWaterCoolest, Essential Leverage Hat, Christopher Cl… haha no.

Photo by Startup Stock Photos from Pexels