Thoma Bravo launches a 🗳️ tender offer for Instructure

Thoma Bravo launches a $2.0B tender offer for Instructure. Golub, Owl Rock, GS and others to provide $775M term loan ⚙️

If you know someone who’d love to get Lever Up in their inbox (or has been involved with the subject of discussion), I encourage you to forward this to them! Follow me on Twitter for programming updates, DMs are open for suggestions. Substack recently enabled comments for everyone, so feel free to share your thoughts below. You can also reply to this email with praise, hatemail, and scoop for the next discussion.

Although I’m “late” to publishing this, in my defense (i), I started writing a few weeks ago, and the situation has evolved since, and (ii) I am both the writer and the editor, so I pretty much own the publication timeline. Disclosure: I worked on deals in the ed-tech and corporate LMS markets in my former life, and have personally experienced the highs and lows of learning software throughout my overpriced academic career.

Target 🎯

Instructure is the company behind the Canvas Learning Management System (LMS) and Bridge (plus some adjacent products). The company was founded in 2008 and launched its flagship product, Canvas LMS, around 2010. Almost immediately, the company set Canvas as an open-core product, publishing a substantial portion of its source code on GitHub. The company makes its money on subscription and support fees for a “full” version of Canvas, and complex integrations and implementation work required to get the system in place.

The LMS software is inherently sticky (long sales cycles, large-institution inertia), and by the time Instructure filed its S-1, they were able to demonstrate healthy contribution margins across cohorts. The community which has sprung up around Canvas is a case study in network effects and competitive moats. The open standards enable organizations to develop, deploy, and integrate additional functionality, furthering the customer captivity. The company has realized over 100% of revenue retention since it launched.

Despite impressive traction in the ed-tech market, Instructure continued to burn cash due to growing sales and marketing costs (47% of revenue) and investments in R&D (32% of revenue). Carl Straumsheim at Inside Higher Ed put the sales and marketing costs in perspective, quoting Brightspace S&M spend of 35 to 40 as a percent of revenue.

Looking for ways to leverage its base code, in 2015, the company launched Bridge, a corporate learning and engagement system. The company has, so far, struggled to realize target growth in this segment and has considered strategic alternatives for the unit. The latest 14D-9 amendment noted that Bridge contributed approximately $20M of revenue and negative ($27M) EBITDA in 2019. It also highlights that Bridge was potentially value-destroying:

J.P. Morgan valued Bridge using a multiple based analysis (which resulted in an estimated range of values for Bridge between ($5.00) and ($3.00) per share) and an intrinsic value approach (which included a sum of the parts analysis resulting in an estimated range of values of $1.50 to $5.25 per share, and a discounted cash flow sensitivity analysis resulting in an estimated range of values of ($3.50) to $4.25 per share)

In 2019, Instructure acquired Portfolium for $43M, a web platform that enables students to showcase their work and providing educators and employers with tools to assess learning outcomes, build pathways, and recruit talent.

In aggregate, in 2019, Instructure grew its revenues to $258M, ending the year with over 5,000 customers. The gross profit margin was 68% or $176M. The company’s continued investment, primarily in sales and marketing, has led to a loss from operations of $86M. Admittedly, this included $57M in stock-based compensation, and the company was close to breakeven on an FCF basis.

Thanks, in part, to the commotion stirred by activists, we also have the summary projected financials management shared with bidders.

Buyer 💰

Thoma Bravo is a Chicago-based private equity and growth capital firm with over $30B in committed capital. The firm focuses on technology investments operates three primary strategies: flagship (traditional private equity and growth capital), discover (smaller and mid-sized companies), and credit. The firm traces its roots to 1980 when Stanley Golder and Carl Thoma left the private equity subsidiary of First Chicago to hang their own shingle. In an interview with David Toll (who also publishes a fabulous PE careers newsletter, subscribe here (not an affiliate, just a fan)), Carl Thoma paradoxically noted that “time is the enemy” of returns, while two paragraphs later highlighting the cause for his biggest missed opportunity - existing companies too soon. #insightful The firm’s history is a data point for the web of connections present in today’s marketplace, so I added a visual representation below.

Not included in the above, Golder Thoma & Co were seeded by William M. Blair, of William Blair & Company. John A. Canning, who was tapped to replace Golder at First Chicago, would spend approximately two years in that role before going on to co-found Madison Dearborn Partners with a handful of others from First Chicago.

Speaking of First Chicago, allegedly the investment arm of the bank, the predecessor to Thoma Bravo and Madison Dearborn, was the birthplace of the “First Chicago Method” of valuation. The practice consists of (i) building upside, base, and downside cases, and (ii) using a multiple-based terminal value, in other words, what most of you do on a daily bases. Next time you’re building scenario toggles into your model, just know whose shoulders you are standing on.

Back to Thoma Bravo. Last January, the firm closed $12.6B for its Thoma Bravo Fund XIII and wasted no time putting that money to work. PitchBook reports that the firm completed 39 deals completed in 2019 alone, including four transactions valued at over $1B.

Market 📓

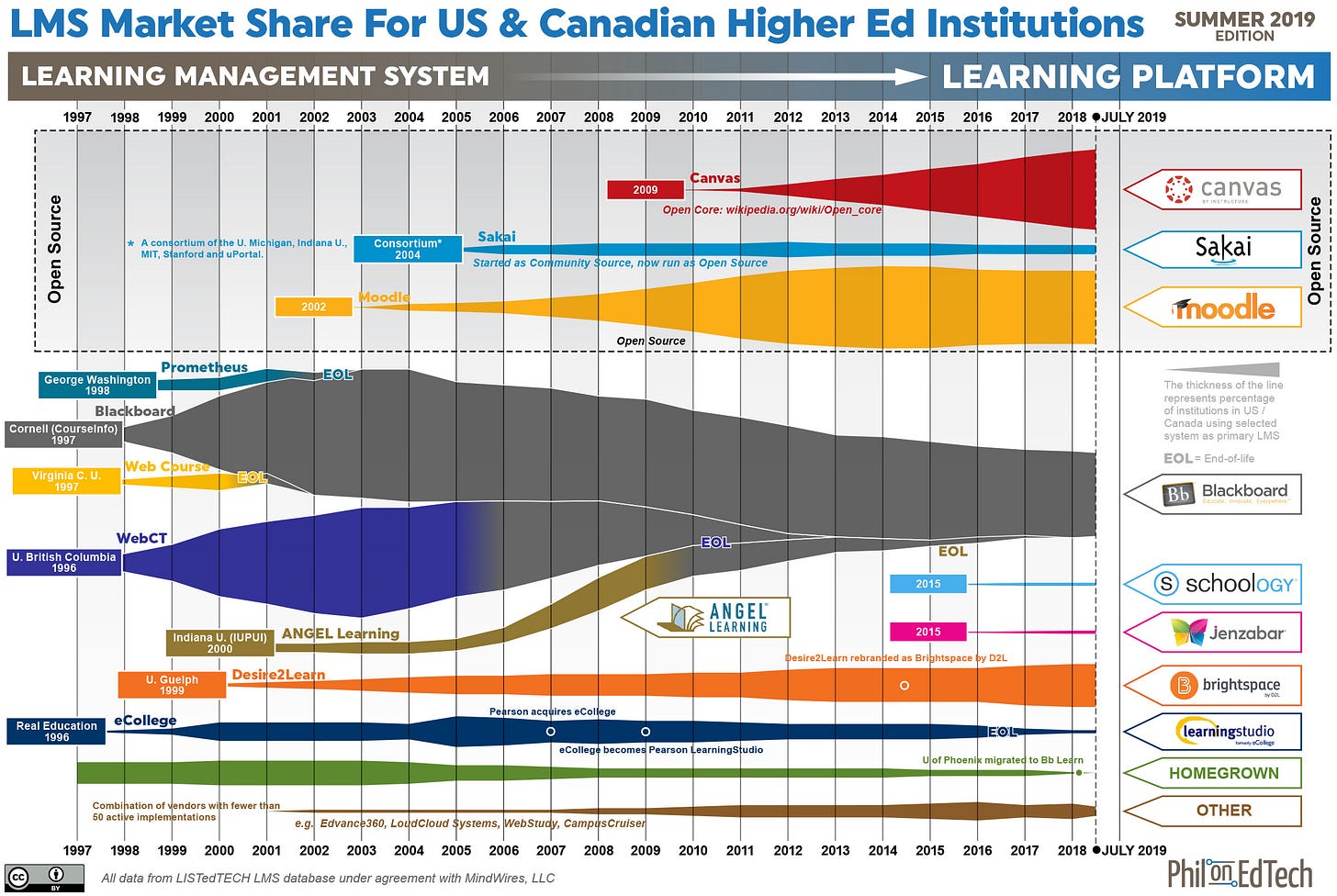

Education: The Education LMS market is historically highly commoditized and offers little in terms of opportunities for pricing power. However, Canvas appears to continue to impress clients with ease of use and an intuitive UI. Having used Canvas, Blackboard, and a handful of smaller LMS systems throughout my academic career, I am inclined to believe market reports touting the superiority of Instructure’s offering. The table below illustrates the rapid adoption of Canvas, chiefly at the expense of the juggernaut Blackboard.

For an entertaining read on comparing Canvas LMS to Blackboard, I strongly suggest this review by Central Washington University.

One faculty member likened Blackboard to a pack-rat trying to cater to every desired option. Another compared Blackboard to a classic car that has been rebuilt piece by piece, but still runs on an old platform.

Corporate: Looking for new avenues of growth, Instructure introduced Bridge in 2015. Bridge repackaged the efforts behind the Canvas LMS to offer solutions for employee development, assessment, and engagement. While the corporate market is more fragmented, it presents a more significant opportunity for Instructure. The company estimated TAM of over $10B in 2019. While I’m skeptical of workforce development and engagement tools broadly, I don’t doubt that there is room to displace legacy providers.

I’m admittedly soft on the corporate LMS opportunity. Perhaps there is space to bundle these with other human resource management solutions (ADP, Workday). While employee assessment tools at many companies may benefit from a spruce up, it is difficult to see meaningful employee development implemented through an LMS.

Moreover, I struggle to think of employees who would proactively engage with these platforms. The training processes I’ve seen are either rudimentary (compliance and administrative), or high-touch and technical (industry-specific financial modeling). Further, industries have established norms and standards for training tools and conventions, and I welcome further argument for why these should be delivered on a standardized platform. And even if they should, the marketplace is increasingly crowded with startups like Absorb, Trainual, Saba, Talespin (AR!), Yunxuetang (Asia), and dozens of others.

Deal 🖋️

Announcement date: December 4, 2019

Market Cap: $2B ($49.0 per share)

Enterprise Value: $2.1B

6.8x EV / NTM Education Revenue

6.2x EV / NTM RevenueAcquisition Debt: $775M Term Loan + $50M revolver

110x NTM (Company-)Adjusted EBITDA?

Golub, Owl Rock, and Goldman are taking the largest stakes here, and Thoma Bravo’s credit funds also signed up for a $130M ticket.

The commitment letter guides L + 4.5-7% depending on leverage and loan type. More here (recommended: “Definition of Consolidated Adjusted EBITDA”).

Despite pressure from investors, including those mentioned below, to explore divestitures or an outright sale, the activists generated a lot of noise about the initial deal price proposed on December 4, 2019.

Thoma Bravo noted they have been following Instructure since at least early 2019 and were actively engaged with the board since the summer (along with a handful of other sponsors). After initial indications expressing interest to acquire the company at $50 per share, Thoma Bravo revised the proposal to $47 per share in November 2019, and ultimately reached an agreement with the board to purchase the company at $47.60 per share in a one-step merger.

Activists (and proxy advisors) began voicing their objections (see below), and it became clear that Thoma Bravo would not gain sufficient votes to affect the merger. In February, the fund submitted a revised proposal to acquire Instructure in a two-step process.

[The fund and members of Instructure board] received analyses indicating that approximately fifty percent (50%) of the outstanding Shares at the close of business on the record date had been sold, making it unlikely that stockholders who no longer held economic ownership in Instructure would consider changing their previously submitted proxies because such stockholders did not have an economic incentive to do so, and that certain current stockholders who may support the price increase could not change their vote in favor of the Original Merger Agreement because of institutional policies prohibiting them from voting in a manner that was not advocated by ISS or Glass Lewis

In mid-February, Thoma Bravo took a look at the shareholders and learned that half of the original holders traded their shares (likely to merger arb funds). On February 18, 2020, the new Merger Agreement and Offer were announced.

The deal presents an opportunity for Thoma Bravo to implement cost discipline across sales and marketing spend and the rest of the cost structure (which it will certainly need to cover those coupon payments). Canvas has delivered strong growth since its founding and continues to acquire new customers in the education sector and an impressive rate. Moreover, cashing out the Bridge business can provide additional early liquidity.

Dissent ⚖️

Instructure’s largest shareholder, Praesidium, had concerns about the sale price and the process, although it seems to have come around. The argument boils down to (i) acquisition price being below pre-deal share price (though one could be skeptical on how “undisrupted” that price was in the days leading up to the announcement), and (ii) the fact that Bridge is really weighing down the enterprise and the board should consider divesting that business to unlock the value behind Canvas.

Bloomberg reported Lateef Investment Management opposed the $47.60 buyout price, arguing the company to be worth at least $60 per share. Notably, Lateef questioned why the current CEO would remain with the Instructure post buyout. More recently, the company disclosed that Goldsmith would not continue with the business. Instead, he is set to receive a golden parachute valued at $22M after the transaction. Lateef CIO Tran also questioned the accelerated process, and whether the board had favored Thoma Bravo all along.

Other investors who opposed the original deal include Oberndorf Enterprises and Rivulet Capital.

With regard to activist claims of a quick process, it is worth noting that the Instructure had posted a “For Sale” sign on its front lawn as early as January 2019, when it first received an unsolicited offer from “Sponsor A,” so it appears the Board had ample time to vet various permutations of strategic alternatives. The December 4, 2019 filing notes 19 NDAs with strategics and sponsors, and the Board’s January 13, 2020 letter to shareholders claims the company contacted 55 potential acquirers. Suffice to say, anyone who had Instructure on their radar for the last 12 months has probably taken a look at the book and developed, at least directionally, a view of the price at which a deal would be attractive. Further, the “go-shop” period through January 8, 2020, provided an opportunity for any bidders with a case of FOMO to swoop in.

Sean Griffith’s efforts (non-paywalled version via Reuters) notwithstanding, merger litigation continues to be a pervasive part of life for M&A professionals. (Coincidentally, the highlighted case above similarly starred Thoma Bravo, in its acquisition of Riverbed Technology). Investor Joseph Post launched a class action lawsuit to demand additional disclosures in the proxy statement filed by Instructure. Selfishly, I enjoy reading through other banks’ fairness opinions and wouldn’t mind getting under the hood of EBITDA Adjustments and projected financials to see how TB is thinking about this deal, so more power to Joe.